You are here

Large Gem Assessments

One of the constant questions that we receive is "Why is a large gem appraised so high?" Frankly, even I am stunned by what these large and rare gems go for on the international market. Every gemologist and gem dealer is familiar with the wholesale and retail pricing guidelines for diamonds and precious gems. In this traditional process, gem assessments follow the 4 C's (Carat weight, Cut, Color, and Clarity) to set the qualifications for for a gem. I will point out four other factors that are not considered for the more common gems on the market.

All gem professionals hold these gem pricing guides that will give the current prices for qualified gems. So, a one carat round diamond will be show a wholesale price of $1400 to $14,000 depending on the GRADE (I3 thru IF). For know just know that a small diamond or gem at 10 cts ($97,000 at IF) are priced much higher per carat that a 1 carat ($14,000 at IF). So, please understand that SIZE seriously multiplies the carat price of similar grade stones. The trouble is that these charts usually only show .001 to 20 carats, and after that, the price is subject to other very important factors.

For example, I reviewed the world's largest Alexandrite finished gem. This amazing gems is almost 50 carats in weight and is listed in the Guinness Book of World Records as the largest such Alexandrite. According the the price guide, the best grade (Extra Fine) only shows weight at the chart limit of 9.99 cts at $6750. Using that measure, the 142 carat Alexandrite carries a value of $957,960. But, can we apply this price to the world's largest gem of its kind? No, we can't. In fact, this gem has been valued by myself and other international gem appraisers at over $25,000,000.

For example, I reviewed the world's largest Alexandrite finished gem. This amazing gems is almost 50 carats in weight and is listed in the Guinness Book of World Records as the largest such Alexandrite. According the the price guide, the best grade (Extra Fine) only shows weight at the chart limit of 9.99 cts at $6750. Using that measure, the 142 carat Alexandrite carries a value of $957,960. But, can we apply this price to the world's largest gem of its kind? No, we can't. In fact, this gem has been valued by myself and other international gem appraisers at over $25,000,000.

Here are the UNIQUE FACTORS that make large and rare gems far outpace similar gems under 20 carats.

- RARITY: You will find thousands and millions of similar gems at 10 carats or less. You will find thousands of similar gems under 20 carats. You will rarely find a gem over 40-50 carats. They may number fewer than ten in the world (depending on quality), and the RARITY of anything drives the price up as an exponential (not multiplier) factor.

- HISTORY: Some gems have even more appreciative value because they have a history. It is here that these gems should be viewed like great art or collector museum value and the appreciation is not just quality, but unique size, and colorful history.

- STORE OF VALUE: In the age of cryptocurrency, people of wealth are looking for something other than cash that is deflating in value. Gold, silver, and precious gems are the traditional "Stores of Value" that may appreciate when stocks, bonds, and cash drop in value. We should add fine art into this category as well.

- BUYER/SELLER ENTHUSIASM: Every art dealer knows that the rarity and history are a huge influence on the price. However, we all know that the price of anything is an open question that depending on the bidding war or competition among multiple buyers. For example, a $1,000,000 house in a time when the house inventory is in surplus (Buyer's Market) may force the seller to accept a $750,000 offer. During a "Seller's Market" the supply of homes for sale is scarce and the sale price could go to $1,250,00 as buyers compete for homes in a scarce market.

These thee "Exponential Price Accelerator" is never a fixed calculation. An appraiser must leave the price guides and consider that special gems should be valued many times more than a 10 carat gem of similar quality.

An Amazing Blue Sapphire with great History: Another unique assessment that I encountered by an amazing blue sapphire weighing 1215 carats in cabochon style. The gem wasn't transparent or would not be used for jewelry. This is frankly a museum piece due to size and history. Owning a gem like this has some important applications. The owner of this rare gem can use its assessed value as a portfolio enhancement. Banks and businesses hold a variety of assets (real estate, gold, silver, copper, gems, and art) in secure locations that offer an SKR (Safe Keeping Record) to assure the owner and creditors that there is proven value for loans or investments.

An Amazing Blue Sapphire with great History: Another unique assessment that I encountered by an amazing blue sapphire weighing 1215 carats in cabochon style. The gem wasn't transparent or would not be used for jewelry. This is frankly a museum piece due to size and history. Owning a gem like this has some important applications. The owner of this rare gem can use its assessed value as a portfolio enhancement. Banks and businesses hold a variety of assets (real estate, gold, silver, copper, gems, and art) in secure locations that offer an SKR (Safe Keeping Record) to assure the owner and creditors that there is proven value for loans or investments.

The history of this one-of-a-kind gem enhances its value as this gem was held for hundreds of years as a treasured family treasure in the country of India. Passed from generation, this revered gem seemed to possess power and blessing, and has a colorful history of ownership. This gem has been valued at $50,000 to $75,000. This gem is rare because of size, rarity, and history. It was a pleasure to actually hold this gem in my hand knowing its amazing journey through history.

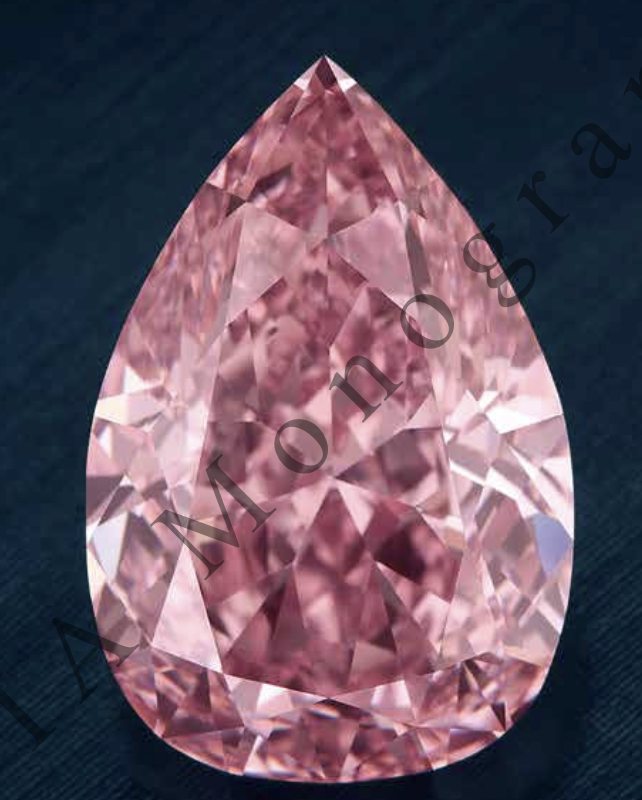

The Desert Rose pink diamond is not the only pink diamond, but is large, beautiful, rare, and highly desired. This 45.56 ct flawless gem is valued at $200,000,000. The price guide places a "Fancy Intense Pink" get at the 5 carat weight at $310,000 to $432.00 per carat. However, the Desert Rose 45.56 ct is priced at $4,389,815 per carat. That is an EXPONENTIAL that no price guide can calculate. This is not priced as jewelry unless you are royalty. This is a gem of museum or prestige that may also sell at another time for $500,000,000. The owner of this Desert Rose obviously see the "Store of Value" for this beautiful and rare gem.

The Desert Rose pink diamond is not the only pink diamond, but is large, beautiful, rare, and highly desired. This 45.56 ct flawless gem is valued at $200,000,000. The price guide places a "Fancy Intense Pink" get at the 5 carat weight at $310,000 to $432.00 per carat. However, the Desert Rose 45.56 ct is priced at $4,389,815 per carat. That is an EXPONENTIAL that no price guide can calculate. This is not priced as jewelry unless you are royalty. This is a gem of museum or prestige that may also sell at another time for $500,000,000. The owner of this Desert Rose obviously see the "Store of Value" for this beautiful and rare gem.

Store Value / Portfolio Building

- DESIRE TO OWN BEAUTY: Large gems of unique character or historic value are used by the very wealthy to store their wealth. Large gems hold their value and will appreciate, but the "Desire to Own" spectacular art, rare cars, or gems happen at a whole other level. To the average person, the Desert Rose is a pretty stone without any sense of the "Pride of Ownership" or "Rarity" of such a gem. That person might dare to spend a few thousand dollars not knowing that people of wealth would pay millions to own this one-of-a-kind beauty.

- MORE THAN INFLATION: A $10 million dollar gem does not appreciate based on inflation or normal market stresses. The price is often determined by the "Museum Value" or prestige that comes by owning such a gem. At auction at Christie's, a work of art or a precious gem may sell for nose-bleed prices, making the seller millions of dollars.

- ESTATE STRATEGY: From an estate perspective, gems can be transferred by inheritance or a gift without any required paperwork. We know that rare gems do not depreciate or else kings, hedge funds, and astute investment groups will hold precious gems in their portfolio. (See NASDAQ Report)

- PORTFOLIO BUILDING: If the goal is to create a portfolio of mixed assets, adding high-value (rare) gems is a practical option. Adding gold and silver to your portfolio is a good idea, but a bulky items to handle. Real estate is always a good idea, but maintenance, taxes, and market downturns must be considered. Gems are portable, require no maintenance, are immune from some taxes, and can be insured against theft. By the way, have all precious gems laser inscribed with GIA or a similar process that is invisible to the naked eye.

- KAWASAKI PRINCIPLE: Do not sell an asset just to turn a taxable profit. Instead, use your gems in an appraised portfolio to LOAN the money that you need. If the intention of the loan is to create a profit or you intend to pay the loan back, there is no tax on the money taken in a true loan. The money earned in the endeavor may be taxed, but the interest you pay back on the loan is considered tax deductible.

- ECONOMIC CRISIS: IN a day when fiat money (currencies) are under attack by mismanagement, inflation, national debt, and even war, cash money may be useless. This happened in post-war Germany and it is happening in countries like Nigeria and Venezuela. Note that Germany made a huge effort to capture art, gold, and gems to shore up its wealth. Gold is good for transactions in bad times, but art and gems hold their value for thousands of years as countries rise and fall.

- SECRECY: These very rare gems usually require no registration or paper trail. No one may know that you possess $10-50 million is precious gems that could literally be transported in a briefcase (not recommended). Gems are considered owned by the hold as long as their is no evidence of criminality. Gems may be exchanged for other assets or services (Hunter Biden, for example) or handed down to the next generation. They can be as private a matter as you allow.

These values are not used best for gems from 1-20 carats as gems of this size are far too commonly held (unless it is a rare gem type). This article is for those whose wealth is in the millions and billions. Even the Bible speaks of a man who found a "Pearl of Great Price" who went and sold all that he owned to possess it. I conclude that he bought the pearl for small dollars to acquire something of great wealth.

Portfolio Building with precious and rare gems is an ancient and proven strategy for multi-generational wealth. Owning anything of great value is a tool that protects your future value and can be used to leverage profitable deals. No asset is the perfect solution and their is always a measure of market risk that includes precious gems. We feel that the adverse risk of precious gems is better than other market risk assets.

Long-Term Philosophy

90% of gold buyers are following the "Bunker Mentality". They buy silver, gold, and guns believing that is their ultimate survival plan against the failure of society and anarchy. The wealthy, however, need more then a bunker mentality. We know from history that times of crisis are periods when billions are lost and billions are made. More than a cache of food, the other strategy is to have the resources to pass through the hard times and emerge stronger than before.

Hard assets like silver, gold, petroleum, precious gems, and great art always survive the worst of times. At the very least, valuable assets give us options that even cash may not afford. When currencies crash, true wealth-based assets retain or increase their value.

In good times, such assets are portfolio builders that banks consider when making loans or prove up to support credit worthiness or supports the financial stability to complete the contract. Whether short-term or long term, holding high-value, certified gems are useful for any person of wealth. Fortunately, gems require minimal maintenance, are portable, and may minimize tax liabilities.

Essentially, a million-dollar plus portfolio may consider 5-25% in precious gems. However, do not think that jewelry, rings, or decorative items are the same a a rare gem. Due to trends, jewelry may go out of style. The best advice is to buy at the "Top of the Market" rather than the bottom. Look for GIA or similar registrations. Look beyond the four C's to strongly consider the power of "Rarity, History, and Prestige". These virtues mark the gems that will endure the ravages of market trends, economic upsets, and dilution.

Avoid any type of "lab grown" gems. Sheer logic tells us that if a 20 carat diamond or ruby can be made in a factory. There will be a flood of imitations flooding the market. Here's why gold is do valuable. There is a finite supply and it is hard to find cheaply. Earth-grown gems should be the only type of gem in a wealth portfolio. Simply stated, anything rare is always more valuable, and anything in over-supply will decline in value.

For those looking to build a portfolio of rare and amazing gems, please call our office